The Challenge:

Creating effective marketing materials for alternative investments is a complex and resource-intensive process. The sophisticated nature of these investments requires content that is both technically accurate and accessible to a diverse range of audiences. It isn’t easy.

Take a look around. You can count on one hand the number of organizations that excel at creating educational content about alternative investments.

Most firms struggle because they lack marketing personnel with a combination of marketing skills and deep investment expertise or they haven’t figured out a good process for connecting their marketing team with their organization’s subject matter experts.

As a result, many firms struggle to support critical sales initiatives, which can negatively impact their ability to grow brand awareness, build their reputation as industry thought leaders, and ultimately increase AUM.

The Solution:

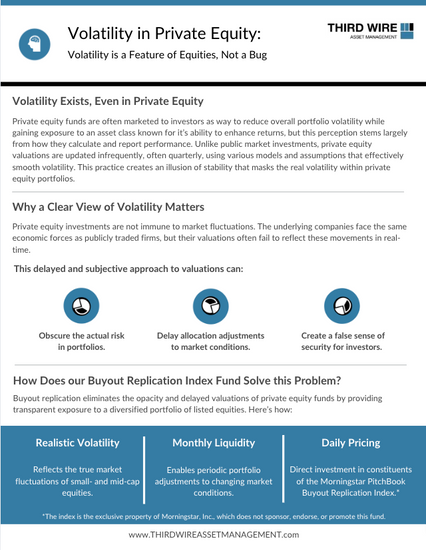

Third Wire Asset Management partnered with us to create clear, compelling investor materials for a new fund they were launching. We built an efficient content development process.

First, we consolidated all fund and index-related data into a secure, centralized knowledge base. This became the foundation for AI-assisted brainstorming, identifying six key content categories and 36 initial sub-topics:

Performance Measurement & Benchmarking

Investment Strategy Applications

Private Equity Education & Comparisons

Technical/Investment Strategy Topics

Portfolio Construction & Implementation

Risk Management & Other Considerations

This structured approach ensured comprehensive, investor-focused content. AI tools like Perplexity, ChatGPT, and Claude accelerated research, refined language, and ensured compliance-friendly copy. Claude was also used for creating various visualizations. Our streamlined process lets human experts focus on oversight and strategic input.

How AI Simplified the Process:

Automated Research: Perplexity was used for research, identifying key statistics, case studies, and trends efficiently. This streamlined the research process and provided a solid foundation for content creation.

Draft Creation: We used ChatGPT for initial drafts and included prompts to ensure they were drafted using compliance-friendly language and to be easily adaptable for different audience segments.

Multi-Level Communication: We also used ChatGPT to adjust content complexity to effectively address targeted audiences (institutional investors and financial advisors) ensuring nuanced messaging.

Compliance Features: A separate compliance-related review to ensure we met regulatory guidelines for the SEC-related marketing rules as well as for guidelines specific to using the Morningstar Indexes brand within their materials, flagging potential risks and ensuring that all outputs met these standards.

Streamlined Production: A standardized one-page layout was created in Canva to easily flow copy into the layout and ensure consistency across materials, reinforcing brand identity while simplifying the design process.

Note: We believe, ultimately, that this entire process can be automated. Limiting human interaction over time to ideation, oversight, and final approval.

Results:

A sample of the first four one-pagers and the standardized legal disclosure page.

Comprehensive Content Development: 36 topics provide a complete suite of investor education materials and ongoing materials to drive marketing campaigns.

Increased Efficiency: AI reduced production time from months to days, enabling rapid deployment of high-quality materials as well as on-the-fly creation of new one-pagers for any new topics or products requested by the sales team.

Enhanced Clarity and Accessibility: Content was tailored to resonate with sophisticated investors while remaining clear and concise.

Sales Enablement: The one-pagers serve as effective tools for educating prospective investors and communicating the fund’s unique value proposition.

Conclusion:

This project is just one of many initiatives aimed at transforming content creation for Third Wire Asset Management. By leveraging AI and industry expertise, we continue to refine and scale our approach, ensuring a steady pipeline of high-quality, investor-focused materials that support their evolving marketing and sales strategies.

Contact us to learn more.

Pure Math Editorial is an all-purpose virtual writer we created to document and showcase the various ways we are leveraging generative AI within our organization and with our clients. Designed specifically for case studies, thought leadership articles, white papers, blog content, industry reports, and investor communications, it is prompted to ensure clear, compelling, and structured writing that highlights the impact of AI across different projects and industries.

.png)